By Olivier Bault

Poland compares to other countries in the European Union in the face of the crisis caused by health restrictions – with a GDP decline of only 2.8% in 2020 and a projected growth of 3.1% this year or 5.1 % in 2022 (according to projections by the European Commission) – economically quite good . Out of the EU as a whole, only Lithuania fared better with a GDP decline of 0.9% in 2020. Two other EU countries had a recession below 3%: Sweden and Estonia.

This advantageous position of Poland is not only due to the fact that it never so strict restric-effects as in other European countries (with the notable exception of Sweden) as the UK, France, Italy and Spain has applied, or that Polish small business owners on various tricks access to despite the Prohibitions on continuing to operate, but also on the weight of its industry, which is less affected by the restrictions than services. In 2019 , the share of industry ( excluding construction) in GDP in Poland was 25.1%, compared with 24.2% in Germany, 19.6% in Italy, 15.8% in Spain, 13.5% in France and 13.3% in the UK.

In March, the value of incoming orders of Polish industrial companies was 33.1% higher than in March 2020, and the value of export orders rose by 37.7%, but it is true that the spring jam started in mid-March 2020, a month in which the industrial production sold had decreased by 2.5% compared to the same month in 2019.

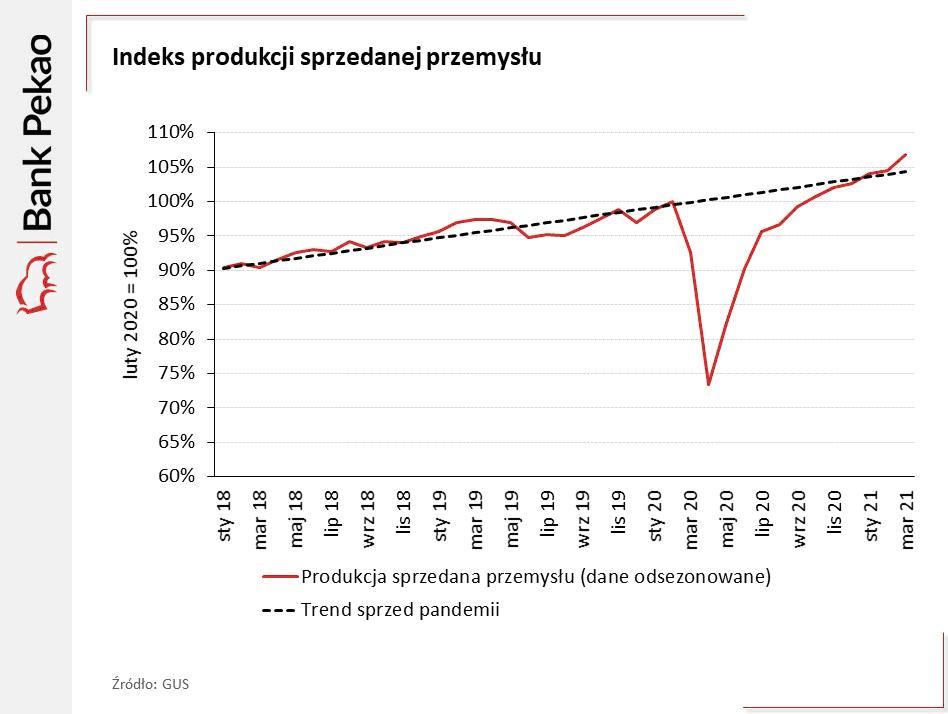

Also in March 2021, the industry’s production sold rose by 18.9% compared to the same month of the previous year, the largest increase in 15 years, after having increased by 2.7% in February 2021 compared to February 2020. In March, for example, the sales of Polish industry rose again above the level that normally results from the upward trend before the pandemic, as shown in this graph published on April 21 by Bank Pekao, which is based on data from the Polish Statistical Office of the CIS:

One of the factors that support the good performance of Polish industry despite the pandemic is the improved economic situation in German industry. Almost 30% of Polish exports go to Germany (29% in January-February 2021, compared with 6.2% for France, 5.5% for the Czech Republic, 4.9% for Italy, 4.8% for Great Britain and 4, 4% for the Netherlands, just to name the most important markets for Polish exports).

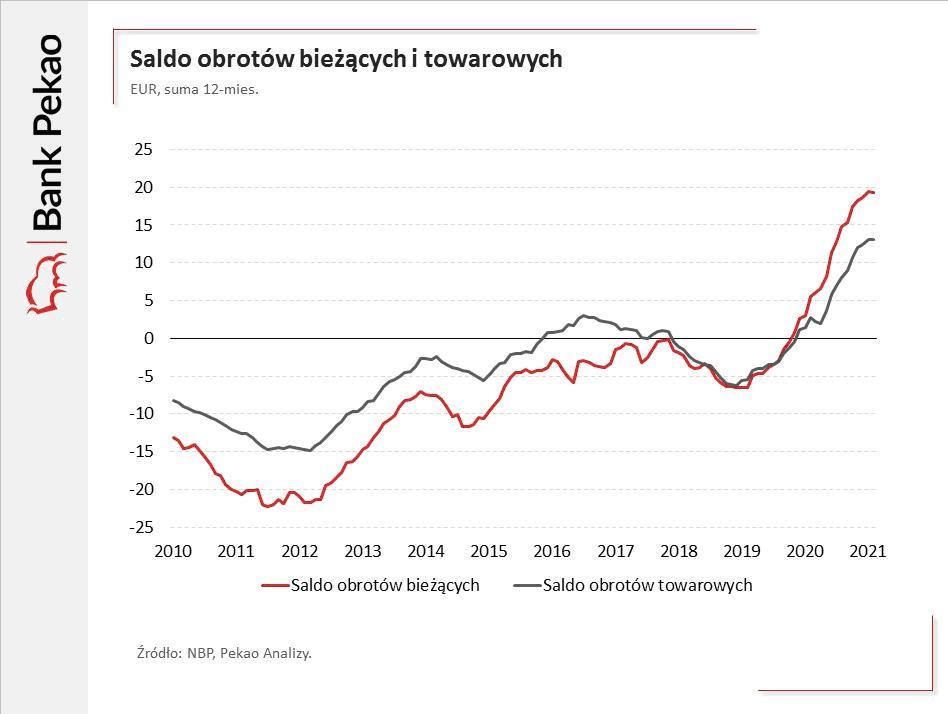

Despite the crisis, total Polish exports of goods continue their upward momentum observed last year , with an increase of 6.2% to € 21.3 billion in February 2021 compared to February 2020, i.e. before the first sanitary measures. At the same time, imports rose by 6% (also in euros). Poland’s current account is therefore still very positive, as this chart published by Bank Pekao based on data from the Central Bank (NBP) shows:

The dynamism of exports is therefore a second important factor alongside the growth in industrial production, which explains the good performance of the Polish economy during this period of the pandemic. This dynamic is partly explained by the fact that Poland is not part of the euro zone and has therefore been able to float its national currency, the zloty. The average value of the zloty before the pandemic was 4.20–4.30 zloty per euro and has fluctuated between 4.40 and 4.65 zloty per euro since March 2020.

From a sector perspective, Polish construction outperforms industry, as construction fell 10.8% in March 2021 compared to March 2020. Like industry, this sector is also suffering from the sharp rise in raw material prices (+ 4.5% between March 2020 and March 2021, with overall inflation of 3.2% in the same period, 7.3% for services alone and 1.9%) for goods). The agricultural sector has suffered many problems, but not particularly from the pandemic itself, and Polish food exports grew by as much as 7% in 2020, after 6.9% in 2019.

In the service sector, business service exports boomed in 2020 with exports growing by over 10% and total exports worth over USD 28 billion, while total service exports rose from USD 69.9 billion in 2019 to USD 67.2 billion a year 2020 fell. In business services, Poland has shown itself to be more resilient than, say, India – a major competitor in the sector – thanks in part to the level of its infrastructure, which enables a quick and seamless transition to teleworking in the first few weeks of the lockdown in Spring 2020 made possible.

For the economy as a whole, the unemployment rate in Poland remains the lowest in the entire European Union, and the average wage in the corporate sector rose by as much as 8% between March 2020 and March 2021. The unemployment rate calculated using the Polish methodology was 6.4% in March 2021, compared to 5.4% in March 2020 and 6.2% in December 2020 and 6.5% in January 2021. But calculated according to Eurostat criteria, Unemployment in Poland was only 3.1% in March, compared to 3.2% in the Czech Republic, 3.5% in the Netherlands, 3.9% in Hungary and e.g. 4.5% in Germany and 7, 9% in France, compared to an EU average of 7.4% and 8.1% in the euro area.

The flip side of the coin is inflation: at 4.3% y / y in April after 3.2% in March and with interest rates close to zero, inflation is eating up Polish savings, fueling the rise in property prices as savers try to invest their money – despite the recession in 2020. The other downside is the widening public deficits.

At 161.5 billion zlotys (6.9% of GDP, which is the EU average ), the public finance deficit increased tenfold in 2020! As a result, the national debt rose from 45.6% of GDP to 57.5% of GDP in just one year, which is still much lower than in other large European countries, with the EU average being over 90%.

Source: UME