By: Spletni časopis

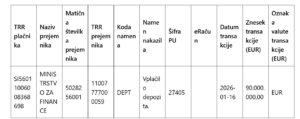

The Health Insurance Institute (ZZZS) sent a €90 million deposit to the Ministry of Finance on 16 January 2026.

The government clearly needs this money, most likely an investment of surplus funds into the single treasury account, because it has had to pay out winter bonuses to the entire public sector outside the approved budget plan, and it has just raised the minimum wage by 16 percent, for which no funds were planned in the budget either. Since this is a large sum of money, and since healthcare services are being limited (to save costs), it is unlikely that the reason lies in large surpluses collected through health‑insurance contributions. We all know that ZZZS now collects substantial amounts from contributions paid by all employees and even pensioners for long‑term care, and that due to the government’s incompetence, this money remains, at least in part, sitting in the account because the government is unable to provide the services it is supposed to. The data on this unusual deposit, available on the public payments portal, is as follows:

In the past, deposits from public institutions into the Ministry of Finance were prohibited, because the state is not a commercial bank for savings. Such transfers would be especially problematic if the money in question were earmarked funds for long‑term care.

I asked ZZZS and the Ministry of Finance for a detailed explanation of the reasons for this deposit and whether ZZZS might have lent the minister €90 million intended for long‑term care, money it cannot spend because so little of the system is actually functioning, and whether these funds could help the budget cover the large number of unplanned pre‑election expenditures. Last year, for example, the government had to find money for winter bonuses outside the approved budget, and it has just decided to raise the minimum wage as well. This wage increase is also outside the budget plan approved by parliament, meaning funds will have to be taken (reallocated) from other budget lines.

When I asked an artificial intelligence (AI) for its opinion on how ZZZS and the government might explain these transfers, it predicted (Google Gemini) the following responses: “It is to be expected that the government will argue that this is business conducted within the framework of the Single Treasury Account (EZR). By law, all public institutions must deposit surplus liquid funds into the EZR. The Ministry of Finance manages this money centrally, which lowers the state’s borrowing costs, and the money has not ‘disappeared’ – it is available to ZZZS whenever it needs it. ZZZS will likely claim that this is normal cash‑flow management. They will say that contributions flow in daily, while major payments (e.g., to hospitals) are tied to specific dates in the month, which creates temporary surpluses in between. But ZZZS keeps separate records and can explain whether this surplus comes from the new long‑term care contribution, which remains unused due to the system’s ‘non‑functionality’.”

After readers alerted me, I managed to find additional data on Erar showing that these ZZZS “deposits” into a special treasury account are a hallmark of the current government’s tenure: