By: Sara Kovač / Nova24tv.si

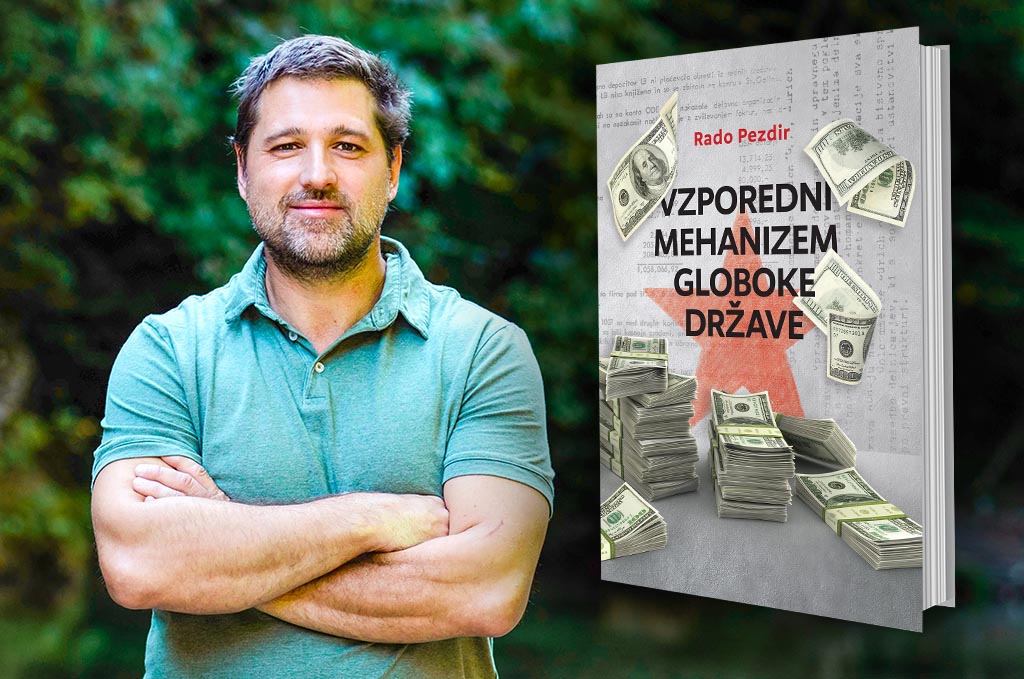

According to the economist Dr Rado Pezdir, who was a guest of the Beremo show, the owner of the company still bears responsibility – the argument “I did not know” is not sufficient under Slovenian legislation. With this, of course, he aimed at Nataša Pirc Musar, who claims that she knows nothing about the affairs of her husband Aleš Musar – even though she is the co-owner of Ruska Dača. “The Ruska Dača is not a separate and unrelated company in this network,” the author of the book Parallel Mechanism of the Deep State explained the ownership structure and, among other things, also said in the show that the Financial Intelligence Service of Bosnia and Herzegovina revealed that Aleš Musar does business through a fiduciary account in Liechtenstein. According to Pezdir, there are quite a few doubts about the correctness of Musar’s operations in Bosnia – unfortunately, many cases are not proven in such a way that they would be accessible.

Faktor banka was founded in the early phase of transition in 1993, it was created from the former internal bank Iskra; The bank, which was created as a greenfield investment, was part of a network in which capital, political, and intelligence interests met, which, according to Dr Rado Pezdir came from the time of socialism. Darko Horvat appeared in the second generation of bank owners with his Aktiva empire. Pezdir wrote in his book Parallel Mechanism of the Deep State that the thesis that Faktor banka was created in order to enable parallel banking in Slovenia is entirely plausible. After the initial consolidation, after the purchase of the fund from SKB Bank, Akiva “rode” with this fund the old Israeli-Slovenian connection, which began in 1945 on the Edo Brajnik – Shaide Dan connection, i.e., the smuggling of weapons for the independence of Israel from British suzerainty and the establishment of the state of Israel and the transport of the Jewish population after the end of World War II. In the 1950s, this began to evolve into economic cooperation and quiet diplomacy and continues throughout.

What role did Aleš Musar play in this? The latter was not the subject of Pezdir’s study, as he soon left after the merger between Aktiva and the Israeli business holding IDB. Pezdir explained that Aktiva was a privatisation fund (former PID), and Musar’s next deals were also PID certificate funds – this time in Bosnia and Herzegovina and Montenegro. “If anything, at Aktiva he learned how to swim in the PID privatisation,” Pezdir said, explaining that it was a mapping of what we had in Slovenia. This was then also seen with the Moneta fund in Montenegro and with the privatisation funds that turned into investment funds in Bosnia – for example, Invest Nova, Privrednik and so on. All this was part of a network, the centre of which was Musar.

According to Pezdir, Musar’s octopus is not exactly transparent, the business is spread over so many countries that the business runs with the help of certain levers, which are called fiduciary accounts or in countries with special tax treatment. “I cannot even claim that this method of acquiring ownership shares in companies is much different from Aktiva, namely, you can see a wide variety of conversions of debts, bonds into shares, exchanges of some shares and the like,” said Pezdir, adding that it is not exactly true that Musar had no connection with Darko Horvat’s network after leaving Aktiva.

When the Republika Srpska securities trading agency scrutinised the Invest Nova fund, it followed that in 2009 there was active business with the purchase of Aktiva naložbe shares by this fund, which was under the management domain of Musar. The same agency for securities trading was in Montenegro – all this was publicly announced, but no one noticed, Pezdir warned, also scolding journalists. In the case of the operations of the Moneta fund, where we find Musar again, there is a decision from which it is clear that ZIF Moneta in the domain of Musar’s network had guarantees with Faktor banka in 2011. This was the year when CG Invest, formerly Aktiva naložbe, was still the second largest owner of Faktor banka, and at the same time Darko Horvat was on the supervisory board of the same bank. Even after the departure of the Musar spouses from Aktiva, the cooperation with Darko Horvat’s network was still present. Pezdir remarked that it was an interesting coincidence that they had guarantees with Faktor banka – perhaps precisely because the owner was a former business partner who was also on the supervisory board.

There are quite a few doubts about the correctness of Musar’s operations in Bosnia

In the decision issued by the securities trading agency of the Republika Srpska in Banja Luka, they warned that Aleš Musar was involved in business on the Slovenia-Bosnia route in violation of the legislation on the management of these privatisation funds. The decision-making on the manner in which the Bosnian fund enters Slovenian companies was non-transparent, illegal from the point of view of Bosnia and Herzegovina. The same decision also shows that Musar did not disclose in the Bosnian fund that he was trading with related persons – this is the case of the sale of bonds to the Slovenian company AG Ltd., which is one of the two key axes in Musar’s network – the Bosnian agency also explicitly warned that Musar was in a conflict of interest, he sold to himself and did not disclose it. With one foot he was in AG and with the other in Nova Invest in Bosnia, the transactions were clouded. Surprisingly, it also follows from the decision that the Financial Intelligence Service of BiH itself revealed that Musar does business through a fiduciary account in Liechtenstein. All this shows that there are not few doubts about the correctness of Aleš Musar’s business in Bosnia, other matters are not proven in such a way that they would be accessible, explained Pezdir.

“Someone who is the owner of a company is still responsible, the argument ‘I did not know’ is not sufficient under Slovenian legislation, as every lawyer knows,” emphasised Pezdir, when the host of the show Beremo Metod Berlec asked him how he comments on Nataša Pirc Musar’s statements that she knows nothing about her husband’s affairs. He explained that Ruska Dača is not a separate and unrelated company in this network but is a company that owns an equity stake in Auratus, which owns an equity stake in STH Ventures, which is one of the two hubs of the entire network. The Jersey company S.T. Hammer Limited, controlled by Musar and his associates and AG Ltd., a company that was privatised in the same way as it happened in Montenegro and Bosnia, also has an ownership presence in this network. When asked whether the Ruska Dača company needs capital investment in the company Auratus and then further in the company STH Ventures in order to do business, Pezdir answered no. Of course, Nataša Pirc Musar must know where the company has a significant ownership stake – business transactions are taking place. If the company contract for the Auratus company is opened, it says that the Ruska Dača has entered, which requires the consent of both owners. Then there is the German company Aulon, controlled by Musar.

In her defence, Pirc Musar often says that everything is perfectly fine because they pay taxes. Does paying taxes mean she is entitled to not know what is going on with the ownership structure? Where does the German company Aulon, which is the main owner of the Ruska Dača, get the funds and what is the purpose of this Aulon, why is the company not registered in Slovenia? These are just some of the questions that Pezdir asks. “However, I understand from publicly available data that the company Aulon was incorporated in 2016 in Germany, on the same day as two of Musar’s colleagues were also incorporated at the same address of the company, I understand that AG was taken over by M. M. Alpha Investment in 2016, that Montenegrin funds were paid out to cover Musar’s ownership in the company AG, that the funds were then liquidated and that the money was transferred from related companies to the company S.T. Hammer,” Pezdir explained the complex ownership structure. The author of the book Parallel Mechanism of the Deep State wonders why such a complicated structure is necessary. What is hidden that the takeover of AG took place from Montenegrin and Bosnian privatisation funds. These are things that are unclear, but the Bosnian regulators found that those privatisation funds in the concordat with Aleš Musar do not operate regularly.

Pezdir also commented on Kučan’s support for Pirc Musar, which he explained by saying that the former party member wants to discipline the Gibanje Svoboda party, in which he will be unsuccessful. As he further explained, Kučan’s power is declining, and his involvement will have consequences for the left.